Tech Roundup: How the AI Boom Masks a Brutal Restructuring

The technology sector entered the final months of 2025 riding twin waves that seem to push in opposite directions. Record-breaking corporate profits and trillion-dollar valuations coexist with unprecedented layoffs and mass workforce restructuring. For tech leaders, engineers, and product managers, this paradox isn’t merely a statistical curiosity—it signals a fundamental reshaping of who thrives and who gets left behind in the AI era.

Nvidia Reaches $5 Trillion Valuation

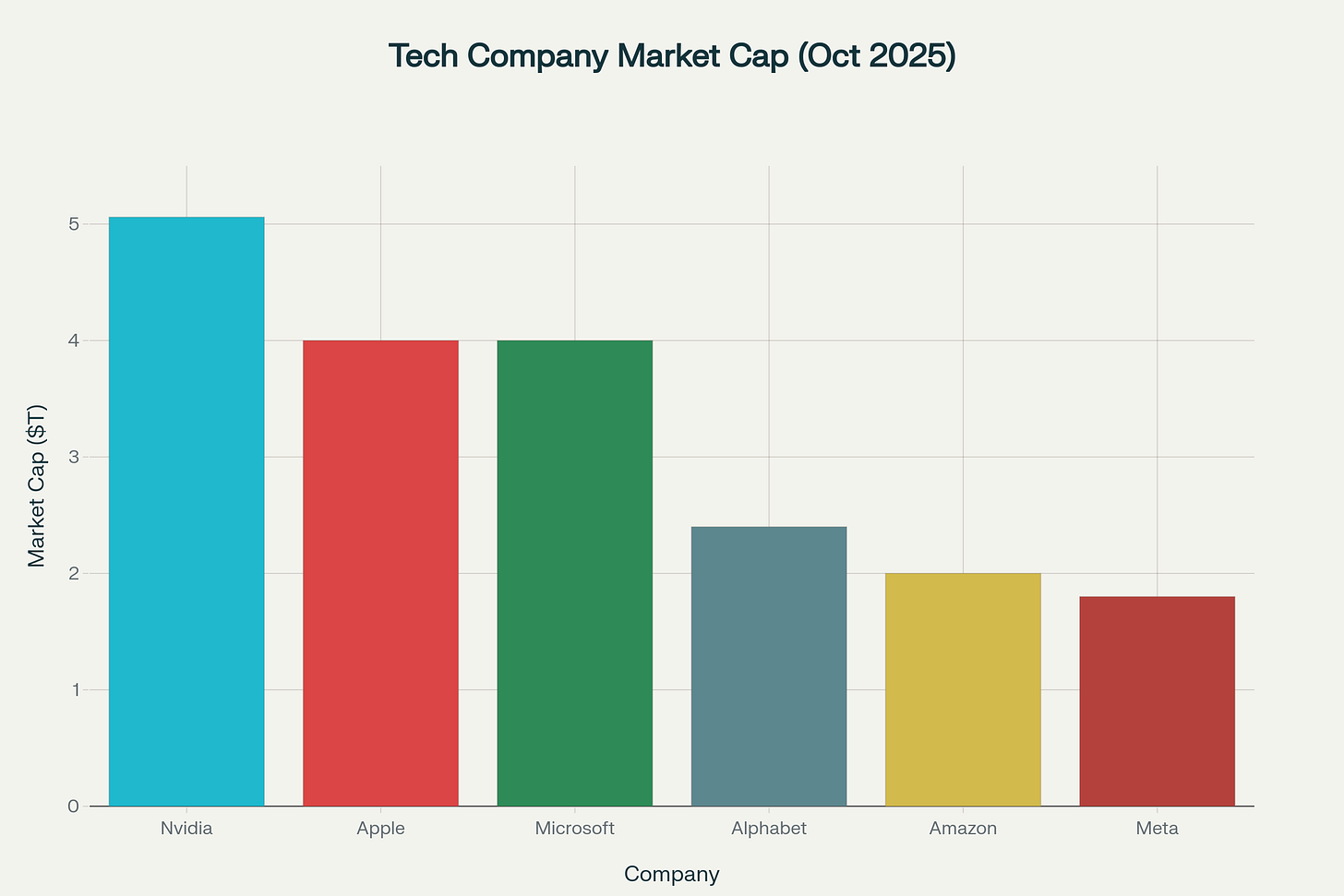

On October 29, 2025, Nvidia became the first publicly traded company in history to achieve a $5.06 trillion market valuation, surpassing Germany’s entire GDP. Just three months earlier, the company had crossed $4 trillion. This isn’t incremental growth—it’s a compressed, exponential trajectory fueled entirely by artificial intelligence demand.

The market capitalization race reflects a winner-take-most dynamic now defining technology. Nvidia’s dominance stems from one undeniable fact: it manufactures the chips powering virtually every major AI initiative globally. CEO Jensen Huang’s announcement at the GPU Technology Conference in Washington that Nvidia anticipates $500 billion in AI chip orders crystallized what investors already suspected—this is only the beginning of the AI infrastructure buildout.

Yet Nvidia’s ascent is part of a broader story. Apple and Microsoft, both of which have long been the world’s most valuable companies, have now joined the $4+ trillion club. Alphabet hit $2.4 trillion, Amazon $2 trillion, and Meta $1.8 trillion. These are not just high valuations; they represent a concentration of market value in technology companies driven almost entirely by artificial intelligence investment expectations.

Tech Companies Bet Trillions on AI Infrastructure

What animates these valuations is not current profit—it’s capital spending commitments that are reshaping how much of Silicon Valley invests.

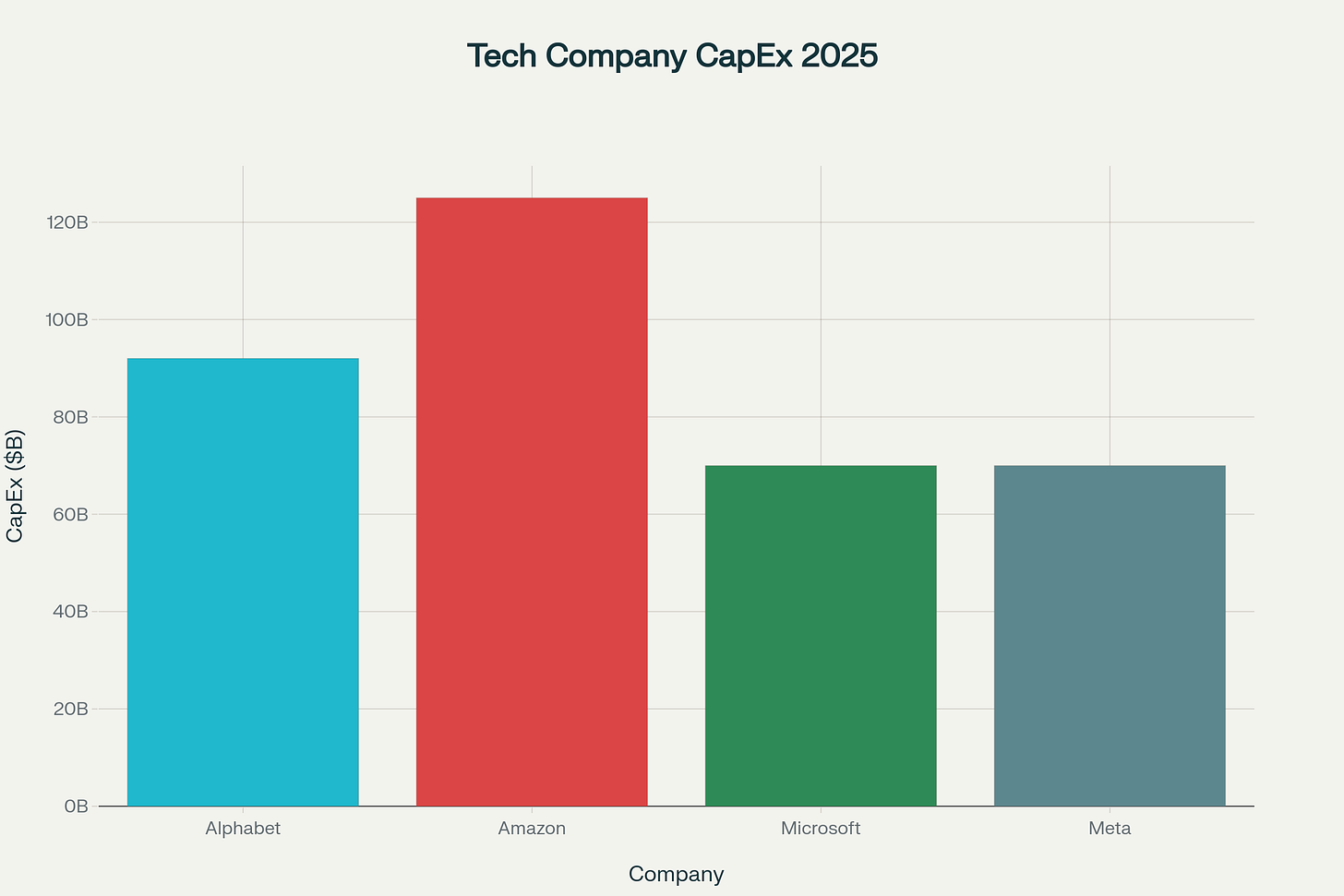

Amazon, posting $180 billion in Q3 revenue and $18 billion in operating profit, raised its 2025 capital expenditure guidance to $125 billion, a staggering increase representing roughly a 50% jump from 2024. Alphabet similarly revised its capex projections upward to between $91 billion and $93 billion for the full year, signaling confidence that AI infrastructure investment will continue. Meta committed to at least $70 billion, while Microsoft is pouring an estimated $70 billion into AI and data center infrastructure. These are not typical corporate investments; they represent a systemic bet that artificial intelligence represents a multi-trillion-dollar platform shift equivalent to the cloud computing revolution.

This spending surge is driving massive revenue growth in cloud computing. Google Cloud’s revenue surged 34% year-over-year to reach $15.2 billion, while Microsoft Azure grew 40%, and Amazon Web Services added $33 billion at 20% growth.

For product managers and engineers, the capital commitments signal one reality: companies are allocating almost unlimited resources to frontier AI work while cutting costs almost everywhere else. The money is flowing. But it’s flowing selectively.

Record Quarterly Results Mask the Underlying Restructuring

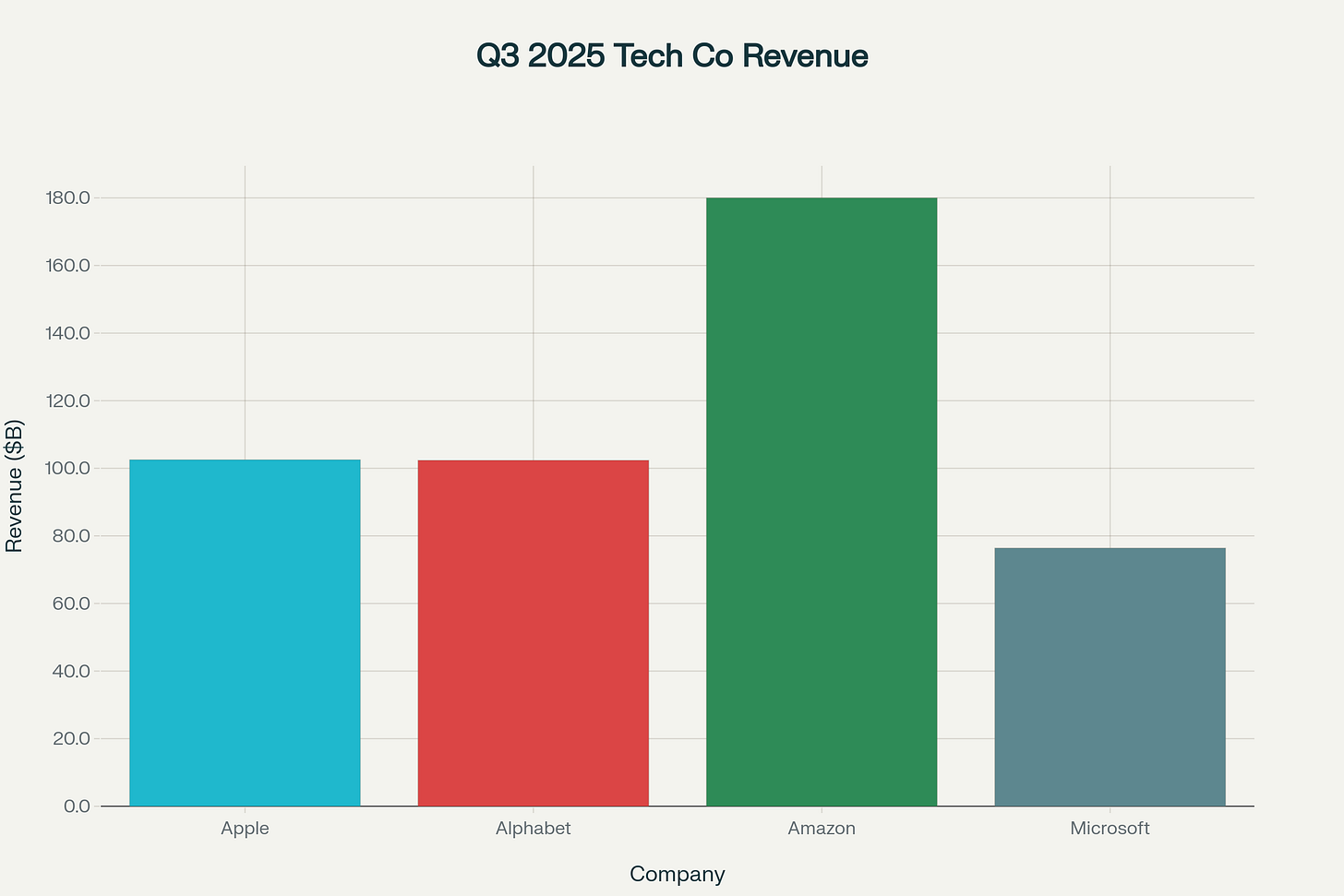

The week’s earnings reports seemed to vindicate the capital spending strategy. Apple posted a record $102.5 billion in Q3 revenue, an 8% increase year-over-year. Alphabet announced a record $102.35 billion in quarterly revenue, up 16% from the year prior. Amazon reported $180 billion in total sales. Microsoft’s fiscal Q4 revenue hit $76.4 billion, up 18% year-over-year.

These numbers represent genuine strength. But they obscure a more troubling picture: profitability and workforce reductions are decoupling.

Massive Profitability Paired with Historic Layoffs

Amazon’s announcement on October 28 that it would cut 14,000 corporate positions—approximately 4% of its white-collar workforce—came just days after posting record profits. More cuts are coming in January. The company had $27.46 billion in net income for fiscal 2025 alone, nearly double the prior year. Yet it cut thousands of jobs simultaneously.

Amazon’s leadership claimed the cuts were driven by “culture” concerns and efforts to remove management layers, not financial necessity. That framing matters because it suggests something more structural is happening: companies aren’t cutting because they’re struggling—they’re cutting because they’re redesigning themselves around artificial intelligence.

The trend extends far beyond Amazon. Accenture announced 11,000 layoffs globally while claiming it would “part ways with the workforce it can’t retrain with AI skills.” Meta cut 600 AI jobs while continuing to hire in its superintelligence lab. The pattern is unmistakable: companies are simultaneously growing, investing heavily in AI, and eliminating jobs. This is selective growth—growth concentrated in frontier AI work, infrastructure, and cloud services, paired with elimination elsewhere.

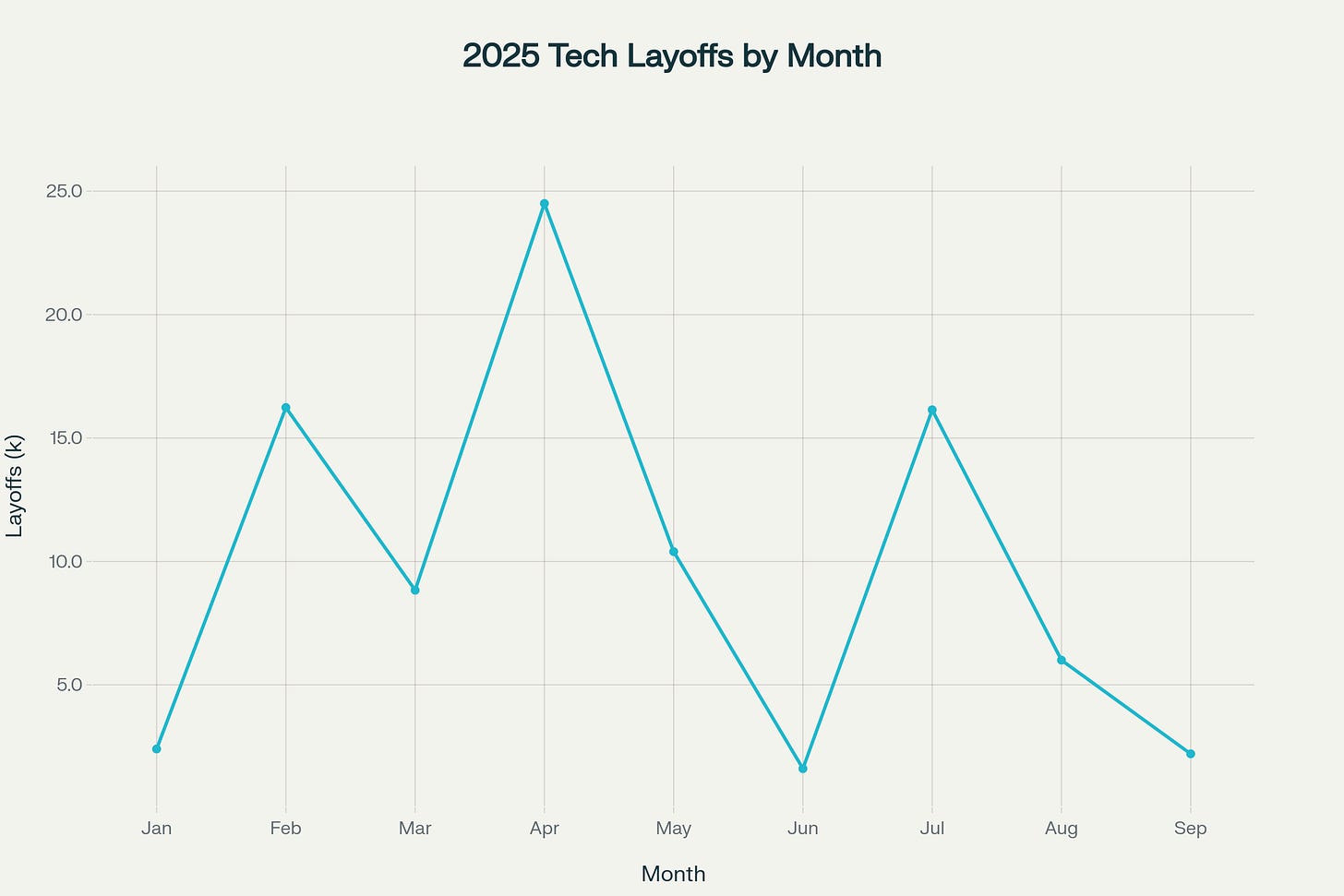

The 2025 layoff data reveals the scope of this restructuring. April saw a spike of over 24,500 tech job cuts, followed by significant waves in February (16,234), July (16,142), and May (10,397). By September, monthly layoffs had stabilized to around 2,205—still significant, but suggesting that companies may have completed their initial rounds of restructuring. Through October, the year has seen approximately 112,000 tech workers laid off across 218 companies, according to Layoffs.fyi—a shocking figure that contradicts narratives of AI-driven job creation.

For tech workers, the message is stark: generalist roles and middle-management positions are increasingly at risk, while specialized AI expertise is in unprecedented demand.

Cloud Leadership Drives Profit Growth, But Who Benefits?

The cloud acceleration is genuine and profitable. Google Cloud saw its operating margin expand to 23.7% in Q3, with backlog hitting $155 billion—a staggering 82% year-over-year increase. More than 70% of Google Cloud’s existing customers are now using its AI products. The company signed more $1 billion+ deals through Q3 2025 than it did in the entire prior two years combined.

This is the future Microsoft and Amazon are racing toward. Microsoft’s Azure is growing at 40%, and AWS is generating disproportionate profits—approximately two-thirds of Amazon’s total operating income—despite representing a smaller portion of company revenue. These are the battlegrounds where companies are making their stand, investing in infrastructure, hiring specialized talent, and generating returns.

But this growth trajectory comes with a caveat: it requires fewer human workers than traditional software development. Infrastructure-as-code, automated deployment, and AI-augmented productivity mean that cloud divisions are growing revenue exponentially while reducing headcount.

Apple’s Resilience

Amid the AI fervor and restructuring elsewhere, Apple presents a counternarrative. The company posted record Q4 fiscal 2025 revenue of $102.5 billion, driven primarily by strong iPhone 17 demand, which grew 6% year-over-year to $49.02 billion despite only eight days of availability in the quarter.

More importantly, Apple has largely resisted mass layoffs. Services revenue hit an all-time high of $28.8 billion, now representing over $100 billion annually. Mac revenue jumped 13% despite no new Mac launch in the quarter. The company forecasted 10-12% revenue growth for the December holiday quarter, well above Wall Street expectations.

For tech leaders, Apple’s strategy offers a different playbook than the restructuring-and-AI-focus approach. Apple has chosen disciplined execution over disruption—delivering incremental product improvements that resonate globally while maintaining operating discipline. The company is investing in AI features but not through radical workforce restructuring. This suggests that there’s more than one path forward in the AI era: aggressive restructuring around AI is one strategy, but execution-focused incremental improvement remains viable for companies with strong brand positioning and global reach.

Nvidia, Blackwell, and China

Underneath the earnings season celebration, a potential geopolitical storm is brewing. The central tension involves Nvidia’s Blackwell AI chips and U.S.-China trade policy.

Earlier in the week, President Trump suggested he might discuss loosening export restrictions on Blackwell chips during his summit with Chinese President Xi Jinping. National security officials in Washington immediately warned it would be a “grave error.” When the summit occurred, Trump walked back the rhetoric, telling reporters: “We’re not talking about the Blackwell.”

Yet the uncertainty persists. Nvidia CEO Jensen Huang stated he hopes Blackwell chips can be sold to China but acknowledged that the decision ultimately rests with the Trump administration. This ambiguity is significant because it means that Nvidia’s long-term growth forecasts—and by extension, much of the chip industry’s trajectory—depend partly on geopolitical decisions outside corporate control.

For tech leaders and investors, the Blackwell question encapsulates a broader risk: the AI boom assumes sustained access to global markets and the ability to export cutting-edge technology. If export restrictions tighten, or if China succeeds in developing domestic alternatives, the growth assumptions embedded in current valuations face substantial headwinds.

Regulatory Tightening

Beyond geopolitics, regulatory scrutiny is increasing. New privacy and automated decision-making regulations are taking effect across jurisdictions. California’s updated privacy rules now require cybersecurity audits and explicit disclosures for algorithmic decision-making, effective January 2026. These aren’t burdensome individually, but collectively they signal that regulators are transitioning from observation to active oversight of AI systems.

For product teams, this means new compliance requirements and operational costs. For engineering leaders, it means architectural decisions that previously operated in a regulatory vacuum now require legal and compliance coordination. These requirements add friction to product development and may slow deployment timelines, particularly for companies operating across multiple jurisdictions.

Netflix’s Play for Content

Netflix’s decision to explore a bid for Warner Bros. Discovery, hiring investment bank Moelis & Co. to evaluate the opportunity, signals that content consolidation may be the answer to profitability challenges plaguing streaming. If completed, a Netflix-WBD deal would concentrate significant IP—Harry Potter, DC Comics, HBO—in a single entity that’s been focused on direct-to-consumer strength.

For tech product leaders in media, this merger signals that pure-play streaming models have hit profitability ceilings. The future may require owning content IP rather than licensing it, or building vertically integrated platforms that combine streaming, advertising, and content production. This has implications for product strategy: rather than pure marketplace models, media tech companies are consolidating toward integrated platforms.

Opportunity and Peril Coexist

The picture that emerges from this week’s earnings, announcements, and regulatory developments is one of profound opportunity paired with substantial structural risk.

The AI boom is real. Companies are spending hundreds of billions on infrastructure, cloud adoption is accelerating, and enterprise demand for AI solutions is genuine. Specialized engineers working on AI infrastructure, LLMs, and cloud architecture are entering a period of unprecedented demand and compensation. Product managers focused on AI-augmented products are navigating genuine innovation opportunities.

But the restructuring is equally real. Over 112,000 tech workers have been laid off in 2025 alone, many from roles that seemed secure a year ago. The message to mid-career engineers and generalist product managers is clear: skills specialization matters now more than ever. The industry isn’t shrinking—it’s becoming more selective about who it employs.

For tech leaders, the challenge is navigating contradictory signals. Apple’s success suggests that disciplined execution still works. Amazon and Meta’s approach suggests that efficiency through restructuring and AI-focused hiring is viable. Most companies will likely adopt hybrid strategies: investing heavily in AI while rationalizing the rest of the organization.

The geopolitical and regulatory backdrop, though, represents a wildcard. Unexpected shifts in export controls, new privacy regulations, or supply chain disruptions could rapidly alter the calculus that companies are making today. The $5 trillion valuation of Nvidia and the record earnings of Amazon and Apple assume sustained access to global markets, stable supply chains, and regulatory environments that remain relatively permissive toward AI experimentation.

That’s the tension defining this moment: the technology sector is simultaneously at the peak of opportunity and facing its greatest uncertainty in years.

PARTNER WITH US

Tech Scoop lands in the inboxes of 27,000+ tech leaders and engineers — the kind who build, ship, and buy.

No fluff. No noise. Just high-impact visibility in one of tech’s sharpest daily reads.

👉 Interested? Fill out this quick form to start the conversation.

Meta cutting 600 AI jobs while expanding its superintelligence lab perfectly encapsulates the 'selective growth' dynamic you've identified where companies aren't optimizing for overall efficency but rather for very specific strategic capabilities. The $70 billion infrastructure commitment alongside workforce reductions reveals that capital is now valued over labor in AI buildout, which fundamentally inverts traditional tech economics. What's particularly striking is that these aren't financially distressed companies making desperate cuts, they're restructuring from positions of strength to concentrate resources on frontier work. This suggests we're entering a period where specialized AI expertise commands unprecedented premiums while generalist roles face systematic elimination regardless of corporate profitability.